We play fair - „We have the suitable qualifications and tools to discharge our obligations in respect of our clients. That enables us to give them accurate and comprehensible information regarding our offer and products. Let’s do our best for this knowledge not to mislead anyone. We articulate transparent and unambiguous model contracts and advertising materials. Contacts with clients are based on trust. Let’s remember that when doing our professional duties, we are always acting on behalf of the PZU Group. If a client loses trust in us, then further cooperation may be called into question.

We are obligated to treat all clients equally. Service should not be denied to anyone, nor should the provision of information or explanations. We approach aftersales service with an equal amount of professionalism.”

Straight-forward products

Area-specific risk: Risk of misselling, i.e. the risk of dishonest communication with clients regarding the PZU Group’s offers to purchase products that do not meet their needs or do so in a manner that is not suitable to their nature.

Approach to management: the PZU Group has implemented policies for the fair design and sale of financial products and services. In addition, according to the Act on Insurance Distribution, an analysis of the client needs is conducted before offering an insurance contract, based on which the client’s needs are determined and products are recommended. Control mechanisms for this process were also implemented, including mystery shopping and sales observations.

Key regulations: Principles regarding the product management system.

PZU Group policies [Accounting Act]

[GRI 103-2] [G4-FS15]

Policies for the fair design and sale of financial products and services

The PZU Group wants for its clients to insure themselves, invest and use financial services in a responsible manner – to make deliberate decisions with a grasp of the nature and mechanisms of the products they purchase.

All Group products and services are meticulously checked by experts before they can be proposed to clients. Lawyers and employees of the Compliance Department ensure that no clause in any agreement violates client interests, and that the entirety is compliant with current case law regarding consumer rights.

The transparency of the Group’s insurance products is ensured by the provisions of the Insurance Distribution Act of 15 December 2017 which entered into force in 2018 and was later amended. The Act is the effect of implementation into the Polish legal order of Directive (EU) 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution (Insurance Distribution Directive). The above is further complemented by the requirements of the regulatory authority applicable in PZU, in particular the Recommendations of the Polish Financial Supervision Authority concerning the product management system, product appropriateness tests and insurance distribution.

All insurance companies of the PZU Group (to the extent appropriate to their operations) fully comply with the relevant standards, in particular those resulting from:

- Commission Implementing Regulation (EU) 2017/1469 of 11 August 2017 laying down a standardized presentation format for the insurance product information document – the so-called IPID,

- Commission Delegated Regulation (EU) 2017/653 of 8 March 2017 laying down regulatory technical standards with regard to the presentation, content, review and revision of key information documents and the conditions for fulfilling the requirement to provide such documents. Consequently, the Key Information Document (KID) accompanies all products for which this is required according to the regulation, chiefly insurance-based investment products and life and endowment insurance policies.

As a result, clients are provided with information that is important to them in an understandable and synthetic format, which enables them to both understand and compare the products offered on the market. Documents are provided as part of the sales process and can also be found on the product websites of PZU Group companies (pzu.pl, link4.pl).

PZU and PZU Życie apply the “Principles regarding the product management system” defining the key requirements and activities to be performed at each stage of the product life cycle to ensure that the developed and distributed products meet the needs and requirements of the target client groups.

TUW PZUW carries out regular reviews of the existing products and services (including those offered by third parties) to assess whether they still bring benefits to consumers. In the first quarter of each year, TUW PZUW prepares collective information on satisfaction of clients’ expectations regarding individual products, analyzing in detail any comments regarding service and contract transparency. Monitoring is the basis for preparation of an assessment of adequacy and introduction of increasingly better solutions. This is also supported by the annual analysis of complaints from the perspective of the product and service and the applied procedures, and the findings and recommendations are reflected in a comprehensive report. On this basis TUW PZUW works out and regularly implements solutions aimed at further improvement of quality. The obligation to offer products responsibly in TUW PZUW is laid down in the scope of duties of the Management Board of the Insurance Company.

Regulations in subsidiaries

All foreign companies also have in place appropriate procedures in the area of product development and sales. Lietuvos Draudimas, operating in Lithuania, in addition to the procedure for launching new services, applies an insurance product policy that defines the processes and basis for the development and modification of insurance products that should ensure the company’s compliance with applicable laws and regulations. The Latvian company, AAS Balta, has in place guidelines for communicating with clients, which are intended to define the general principles of communication with the company’s current and prospective clients. It also applies policies for identifying client needs and managing product changes and development. The companies in Ukraine implement corporate sales policies defining the business rules for providing insurance services to corporate clients, as well as direct sales policies describing the rules for organizing direct sales at all stages.

Banks operating within the PZU Group make sure that the products and services they offer are available to people who genuinely need them and for whom they can be of real benefit.

In accordance with generally applicable laws and regulations, both at Bank Pekao and at Pekao Group companies offering financial products and services, there is a number of regulations defining the business standard, as well as establishing rules of conduct in order to protect clients’ interests, and to mitigate compliance and reputation risks connected with the sale of products and services to consumers. At Bank Pekao, this area is covered in a comprehensive manner by the Policy for new product deployment and the Rules for creating marketing communication. The standards of offering and sales are further defined in the Rules of selling credit and payment products to consumers in Bank Polska Kasa Opieki Spółka Akcyjna and the Policy for the sale of investment products. The first document relates to the Bank’s activities regarding the product sales process, and contains general guidelines for advertising products to clients. It also contains a sample list of improper practices in the process of selling credit and deposit products. The Policy establishes uniform rules for the sale of investment products for all organizational levels of the Bank and provides consistent assumptions regarding the standards for implementation of investment products. The risk of misleading the client with respect to the product designation is managed through ongoing reviews, i.e. through the process of evaluating marketing materials by, among others, the Compliance Department. The process of providing opinions on marketing materials and business instructions is covered by the Bank’s Internal Control System.

The Code of Conduct of the Pekao Group prohibits practices that are detrimental to collective interests of consumers, such as:

- failure to provide consumers with accurate, truthful and complete product information,

- application of prohibited contractual terms;

- unfair market practices or acts of unfair competition;

- offering consumers to purchase financial services that do not meet the needs of those consumers or offering to purchase those services in a manner that is inappropriate to their nature (misselling).

Alior Bank applies the Policy of preventing dishonest sales in order to counteract the practice of misselling. The document lays down the rules that must be applied in the process of designing and distributing products. The product shelf has been reduced and selected offer elements may be distributed only by authorized channels (e.g. Private Banking) and employees who have the appropriate knowledge and experience. The sales processes are subject to regular monitoring for the threat of misselling. There are defined rules of handling identified cases of inappropriate sales.

Internal requirements concerning the labeling of products and services and information regarding them

All of the PZU Group products belonging to the four major product categories (life insurance, non-life insurance, health and investment products) satisfy the statutory requirements:

- within the scope of general policy conditions: the PZU Group directly applies the Insurance and Reinsurance Activity Act. Additionally, the product development procedures refer to a clause on the mandatory preparation of general terms and conditions of insurance;

- with respect to KID (Key Information Document) for investment insurance – the PZU Group directly applies the PRIIP regulation and the product development procedure;

- with respect to the Insurance Product Information Document (IPID), for non-life insurance – the PZU Group directly applies the clauses of the Insurance Distribution Act as well as the principles regarding the product management system and the product development procedure.

Since 2018, no failures to comply with regulations or codes concerning the labeling of products and services or marketing communication have been reported in PZU and PZU Życie.

Advertising ethics

Area-specific risk: Compliance risk concerning the generally prevailing laws and guidelines of state authorities and reputational risk.

Approach to management: The Marketing Department uses the practice of verification of planned marketing messages prior to their publication in terms of their transparency, authenticity and accuracy of information contained therein with other PZU entities, in particular the Legal Department and the Compliance Department (for compliance risk, including compliance with the law – risk of misleading the consumer, use of messages infringing the addressees’ interests) and pertinent departments responsible for a given product (consistency of the message with the facts – risk of misleading consumers).

Key regulations: Code of Ethics in Advertising; Rules for giving opinions on marketing activities and activities in internal and corporate communication.

PZU Group policies [Accounting Act]

The PZU Group attaches a lot of importance to proper shaping of the brand image and the advertising message associated with the product offering. Consequently, it advertises its products and services responsibly, in accordance with the rules laid down in the PZU Code of Ethics in Advertising. The Code is a collection of additional standards, independent of the provisions of law and the guidelines of the Polish Financial Supervision Authority. All actions covered by the provisions of the Code should be compliant with the law and good practices, based on social responsibility, and consistent with the principles of fair competition.

The main rules in the Code:

- advertising does not contain discriminatory contents, respects human dignity and does not challenge animal rights;

- the message is not misleading and does not take advantage of the clients’ ignorance;

- data presented in advertising are true and documented.

The Code also regulates the event sponsoring rules. It clearly stipulates that they may not infringe good practices, expose facilities of historical or artistic importance to harm, or exert negative impact on the natural environment.

Responsible marketing communication is also supported by:

- The Marketing Policy which defines the aims, standards and principles of conducting marketing activity in the PZU Group. It focuses on ensuring consistency of all marketing activity and the message, as well as compliance with the prevailing provisions of law, in particular with the regulations on protection of competition and consumers and fighting unfair competition, as well as the guidelines of public authorities.

- The Rules for giving opinions on marketing activities and activities in internal and corporate communication, which regulate the procedure for issuing opinions by the Compliance Department on marketing materials in terms of compliance risk.

Action synergy

Caring for better understanding of the users’ purchase path, the number and quality of interactions with the PZU brand, products or services, and aiming to adapt the communication more effectively to the user, in 2020 PZU implemented a new analytical and media platform. Since then, all activities conducted as part of direct marketing have been centralized. Each time, as part of campaign activities, the effectiveness of the specific advertising channels is reviewed and compared. Thanks to this solution, PZU conducts its works based on user segments whom it reaches with the appropriate advertising message.

The marketing activities are evaluated in terms of compliance risk, including with regard to compliance with the law – risk of misleading the consumer, use of messages infringing the addressees’ interests and in cooperation with pertinent departments responsible for given products (consistency of the message with the facts – risk of misleading the consumer). Experts check, among other things, whether a given message entails a risk of PZU and PZU Życie suffering a loss of their good name.

The Legal Department’s opinions on marketing and communication activities are based on the principles set forth in separate internal regulations regarding the organization and provision of legal assistance in PZU and PZU Życie.

Agent Ad Generator – online platform offering templates of advertising materials

In an attempt to ensure consistency and correctness of its marketing message, PZU actively supports agents by providing them with tools that effectively enhance their work environment. On one hand, advertising is crucial in the agents’ work, but it is equally important to follow the rules of business communication and legal standards concerning the insurance market. This is facilitated by the Agent Ad Generator – an application with ad templates (e.g. flyers, banners, billboards, print ads, etc.) that can be filled in by the agents with their contact details. Thanks to the standardized advertising templates that cover a wide range of products and offer multiple formats, agents avoid legal or content-related risks. They can download ready-to-use materials they need, enter their contact details and publish electronically or have them printed at a print shop. As a result, we ensure:

- high quality of materials used by the agents;

- consistent communication;

- compliance with the law;

- optimization of the material development process;

- we save time and provide our agents with new opportunities.

In accordance with the applicable internal regulations, marketing and advertising activities carried out by Bank Pekao and Pekao Group take into account the provisions of generally applicable laws and guidelines of the regulatory authorities, the principles of fair trading in the financial market, good practices and clients’ declarations of will concerning such activities. Moreover, they are carried out in compliance with the Bank’s communication strategy, in keeping with the visual identity and image, the adopted internal regulations and with respect to the clarity of communication. Bank Pekao adheres to the Code of Banking Ethics of the Polish Bank Association and the Best Practices of the Financial Market adopted by the Polish Financial Supervision Authority. The key regulations in this respect include the Policy for new product deployment and the Rules for creating marketing communication. The Code of Conduct in the Pekao Group emphasizes that each employee is an ambassador of the products and services offered both by Bank and other Pekao Group entities.

Bank Pekao makes every effort to ensure that the advertising message does not undermine public confidence in advertising activities, does not contain content or images that offend commonly applicable moral norms, does not abuse client confidence by exploiting clients’ lack of experience or knowledge, does not appeal to fear, does not contain elements that could lead to or encourage acts of violence and, finally, does not condone discrimination, in particular on the grounds of race, religion or gender.

In Alior Bank S.A., the advertising ethics issues are covered by the Code of Conduct in Alior Bank. In accordance with the Code, the bank’s communication is open and transparent with a view to strengthening its reliability and clients’ trust. All promotional and advertising activities are in compliance with applicable laws, impeccable in ethical terms and in accordance with best market practices. The bank informs about its products and services in a reliable, unambiguous and impartial manner, and the form of presentation is not misleading. The content and message are easily understandable for all audiences. In its message to its clients, the bank does not overstate the benefits in an effort to downplay the costs and risks associated with acquiring a particular product or service.

Plain language

“Using clear and understandable language is a condition of effective communication and good relations with the clients. PZU is a market pioneer in this respect. We have set up the Plain Language Department which makes sure that understandable language is a standard in our company. We simplify letters and client information, giving it graphically transparent form. We have created a special app thanks to which our employees can check whether the text complies with the rules of plain language before sending a letter or an e-mail and get tips regarding the appropriate form. The PZU Plain Language Department’s groundbreaking initiative is the “Encyclopedia of Simple Polish”, which provides principles of accessible communication.”

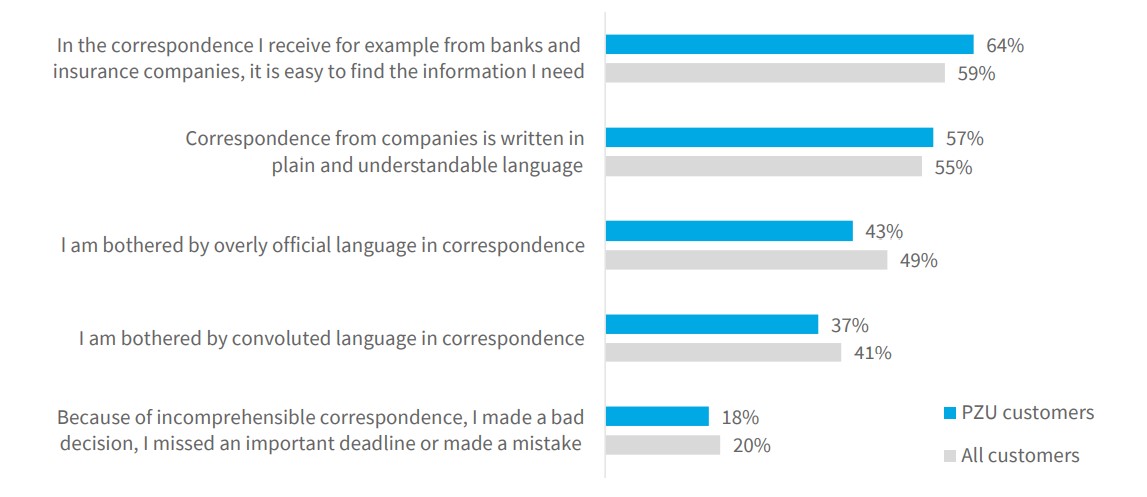

“Using clear and understandable language is a condition of effective communication and good relations with the clients. PZU is a market pioneer in this respect. We have set up the Plain Language Department which makes sure that understandable language is a standard in our company. We simplify letters and client information, giving it graphically transparent form. We have created a special app thanks to which our employees can check whether the text complies with the rules of plain language before sending a letter or an e-mail and get tips regarding the appropriate form. The PZU Plain Language Department’s groundbreaking initiative is the “Encyclopedia of Simple Polish”, which provides principles of accessible communication.”A survey carried out by Norstat Polska has shown that PZU’s clients declare more frequently than other clients that they can easily find the information they need in the correspondence they receive and that the information is written using understandable language. This is the result of PZU’s consistent efforts to ensure straightforward, clear and transparent communication with clients. The importance that PZU attaches to this area is confirmed by establishing the Plain Language Department in 2020 in place of the earlier team.

The Department performs its tasks, introducing language standards in communication with clients, shareholders and business partners. It also develops templates for letters to and responses for clients. These documents are crucial to the positive experience of millions of people in their interaction with PZU. Launched in 2021, the new PZU Auto policy template will reach a larger audience than most Polish newspapers.

Moreover, the Plain Language Department conducts numerous training courses for employees and promotes the principles of simple Polish during conferences, webinars and using internal communication channels: the PZU24 service, regular newsletters and the “Świat PZU” magazine. It is also involved in external communication, promoting PZU as a company which attaches a lot of importance to ensuring that information conveyed to clients is clear and understandable.

It cooperates with linguists from renowned academic centers: Institute of Plain Polish of the University of Wrocław and the Polish Language Institute of the University of Warsaw.

Standards and tools

PZU is the only insurer in Poland that boasts as many as four “Simple Polish Certificates”. This is a quality certificate awarded by the Institute of Plain Polish of the University of Wrocław, confirming that certified texts comply with the international plain language standards.

PZU, as the first insurer in Poland, launched a special app named “It is simple!” for analyzing texts from the linguistic perspective. It enables PZU employees to check whether the texts they write contain incomprehensible phrases or whether the sentences they use are excessively complicated or too long.

Understandable communication is also supported by:

- “Simple language strategy at PZU”, i.e. a collection of universal rules applied in communication;

- “Standards of correspondence with clients”, which sort out the templates of official communication with clients;

- “Standards of internal correspondence”, which unify the existing form of communication within the company;

- “Effective communication management policy”, defining the principles of communication with clients and within the organization along with the methods of their implementation and monitoring.

Encyclopedia of Simple Polish

The publication of the “Encyclopedia of Simple Polish” in 2021 was a groundbreaking initiative of PZU. It is the first of its kind on the market. It is intended to promote clear and easy-to-understand language in business, especially in communication with clients. It was prepared by the PZU Plain Language Department, in cooperation with the Polish Language Institute of the University of Warsaw.

The “Encyclopedia of Simple Polish” includes over 3,000 terms, constructions and topical entries. The “Corporate Speech Dictionary”, comprising several hundred terms, is the main part of the “Encyclopedia”. It provides their meaning and examples of usage, suggests whether they are worth using and which words can be used to replace them. The Encyclopedia also includes a chapter dedicated to “Difficult Forms” and a section on the principles of straightforward communication.

The aim of the publication is to promote plain Polish in non-plain domains. PZU strives to set the highest standards and promote market trends in this regard for the sake of its clients and of the correct Polish language. By doing so, it gains confidence of its clients and seeks to encourage other companies to do the same.

Bank Pekao continues to work on simplifying the content of its messages as part of the “Simply in Polish” program. In 2021, the Simple Communications Committee was established to recommend that business units simplify specific texts addressed to clients and those created for internal communications. As a practical measure, more than 40 employees started attending the course for plain language consultants provided by linguists. Those who complete the course will help other employees create simple messages. They will also participate, as trainers, in an in-house training program on plain language. The Bank actively participates in the work of an interbank group under the auspices of the Polish Bank Association, whose task is to develop standards for plainly written bank documents.

Alior Bank also continued the process of simplification of its client communications. The Bank has established a Communication Simplification and Sales Quality Management Team. Measures taken to simplify communications included, among others, messages of the hotline voice assistant so that the voicebot’s statements follow the rules of plain language. Also, more than 700 documents and information were simplified, and the “Plain Writing Manual” and two e-training courses were made available to the Bank’s employees. Moreover, Alior Bank together with other banks signed the “Declaration of banks on the plain language standards” (initiative of the Polish Bank Association). It also joined the working group for simple banking communication, which operates at the Polish Bank Association.

Plain language at LINK4

Since 2017, LINK4 has been changing its communication with clients to make it simple and easy to understand. The plain language project involves both simplifying documents addressed to clients as well as training and workshops for employees regarding the principles of plain writing. Starting from 2021, all general terms and conditions of motor insurance are written in plain language. To mark the Plain Language Day, all employees received a brief Plain Writing Guide, i.e. a set of internally developed rules for writing in a manner that is accessible and understandable to every client. The Management Board Client Experience Team is responsible for the plain language project. LINK4 believes that insurance should be simple, and using clear and easy to understand language is a natural part of the process.

Conferences and training

Annual language conferences organized by the PZU Plain Language Department bring together a record number of PZU employees – more than 1,600 in 2020, and the same number in 2021. During these meetings, the most eminent linguists in Poland, as well as specialists in the field of communication and customer experience, share their knowledge and experience.

In 2021, a conference “Down with the formal style!” organized by the PZU Plain Language Department won the prestigious Meeting Planner Power Awards as the best educational event online. Members of the jury appreciated the original way to promote plain and communicative language in business.

The Plain Language Department also provides language training and workshops, with over 1,300 participants in 2021. They are run by the authors of the Polish effective communication model. During practice sessions, participants simplify complex content and prepare letter templates to be used in communication with clients. In 2021, more than 320 PZU employees took part in workshops organized by the Department.

Seller network

The PZU Group has created the geographically biggest sales network in Poland. As a result, clients enjoy easy and convenient access to financial products and services. The Group also ensures quality service by upskilling the sellers and providing them with modern tools, removing architectural barriers for people with disabilities, and recently by adjusting procedures and protective measures to the current epidemic threat related to COVID-19 pandemic.

The PZU sales and service network includes:

- 409 branches with convenient access across the country with 189 in small communities;

- 9.7 thousand tied agents and agencies;

- 3.2 thousand multiagencies;

- over 1 thousand insurance brokers;

- electronic distribution channels.

The PZU Group’s clients in Poland have also access to Bank Pekao’s distribution network (650 branches) and Alior Bank’s distribution network (600 branches, including 173 traditional branches, 7 Private Banking branches, 13 Corporate Banking Centers and 407 partner centers; Alior Bank has also 55 branches in Romania). Both banks have professional call centers and mobile and internet banking platforms.

When it comes to bancassurance and strategic partnerships, the PZU Group collaborates with 12 banks and 20 strategic partners. The PZU Zdrowie network has approximately 2,200 partner and over 130 own centers.

Cooperation with the banks within the PZU Group (Alior Bank and Bank Pekao) forms an additional platform for PZU to build lasting client relations. At the end of 2021, more than 8.5 thousand banking advisors (5 thousand in Bank Pekao and 3.5 thousand in Alior Bank) were enrolled in the Register of Insurance Agents.

A comparable number of advisors compared to the data for 2020 is a result of the deletion from the register of persons whose type of cooperation with PZU does not require a license from the Polish Financial Supervision Authority, or persons who no longer work at the banks. In 2021, PZU examined and registered approximately 2,100 new individuals who obtained license from the Polish Financial Supervision Authority.

PZU branch network

The network of 409 standardized PZU branches is evenly distributed across Poland in carefully selected locations. PZU branches are the only distribution channel ensuring in each outlet comprehensive sales and aftersales service of PZU Group’s non-life, life and pension insurance and investment products. The offering in PZU branches is targeted at individual clients as well as businesses from the small and medium-sized enterprise (SME) segment.

PZU Tied Agent network

The priorities for the management of the tied agent network include implementing the PZU Group strategy and adapting the sales network to the challenges of the modern world. The pandemic had a significant impact not only on the products offered by the PZU Group, but also on the way we communicate and sell insurance. In a very short time, procedures and tools were changed to make it possible to sell insurance during major lockdowns. The sales network had to transform rapidly to remote forms of contact with the clients. The changes covered many areas of the companies’ operations, but ultimately focused on ensuring that the accessibility of the offer to clients remained at the same level. The actions taken at the beginning of the pandemic have been continued and expanded. Clients can contact their agents in a number of ways: personally, by phone or via the mojePZU app.

It was also a challenge to maintain the size of the sales network as it had been before the pandemic, and PZU took a number of actions with a view to preserving jobs and salaries of the sales network.

Improvement of the professionalism and quality of customer service in the agent’s offices, and increasing their physical presence in the field are the priorities of the network development. Attractive equipment and marketing signage of the offices, training on service quality standards, substantive support for the sales teams and even financial support from PZU – all this helps agents to attain the highest level.

One of the priorities remained the development of the sales network in terms of making it universal. This means that the same agent offers products of many companies within the PZU Group. Agents become professional advisors at each stage of the client’ life. As a result, clients may insure their property, buy medical and life insurance and take care of their pension – all from a single agent.

PZU Tied Agents use a system dedicated to PZU Tied Network, which among other things allows them to reach a greater number of clients with a new offer. On the other hand, agents have the opportunity to keep all client information in one place. In the near future, agents will also have the ability to analyze client portfolios in terms of various parameters and the ability to quickly create offers directly in the system, which will make it possible to better tailor the offer to the clients’ needs.

As at the end of 2021, PZU had nearly 1.5 thousand tied agent offices in Poland. However, over 3 thousand out of approx. 5.3 thousand tied agents had authorizations to sell PZU and PZU Życie products.

Despite the pandemic, PZU focuses on expanding its tied agent network. In 2021, more than 40 new offices were opened, mostly in localities where no PZU tied agent had been present so far. These actions increase accessibility to products and services while reducing financial exclusion.

PZU also conducted recruitment campaigns, promoting the agent profession and attracting new candidates. In 2021, more than 500 new agents were recruited who are provided with a dedicated onboarding program to prepare them to work.

Portfolio Development Teams

As regards the Tied Agents channel, two-person Portfolio Development Teams were appointed in each Sales Area. They are responsible for actively supporting the sales of life and health products offered by Tied Agents and for monitoring the growth of the sales network. The teams actively participate in and oversee the implementation of new PZU Życie solutions in the non-life network.

PZU develops and promotes the agents’ online presence:

- it sets up their websites, which we then put up on the www.agentpzu.pl site;

- prepares Google “business cards”;

- and Facebook profiles.

The visit statistics and information from agents confirm that these efforts help them reach a broader group of clients.

PZU Życie Tied Agent network

In 2021, the PZU Życie Tied Agent Network also saw a number of changes as a result of implementation of new products, portfolio-related works, recruitment and development, as well as changes related to the COVID-19 pandemic.

In particular, the increase in client interest in health insurance designed to cover financial needs in the event of health impairment caused by illness or accident has highlighted the need to train the sellers to efficiently discuss health needs with clients and present health insurance solutions based on those needs. In this regard, a training program based on the proprietary model named TRINS and carried out via a dedicated learning platform was launched in 2021. The program provides Insurance Agents and Advisors with special sales tools, as well as teaches how to use information and facts about the situation on the domestic and foreign service and health insurance markets in order to submit an appropriate offer.

Insurance Agents and Advisors were also trained in the area of effective use of remote communication means (use of instant messaging services, improving skills to conduct remote meetings effectively) in response to a significant interest of clients in this form of contact.

In 2021, PZU Życie conducted two recruitment campaigns. As a result, approximately 100 new Insurance Agents and Advisors apply for training each month It is important to note that at the same time a qualitative change is taking place. Although the number of sellers has remained unchanged, the Insurance Advisors who have a higher sales effectiveness are becoming more and more numerous.

PZU Życie intends to develop its Insurance Agents’ and Advisors’ ability to conduct meetings remotely by promoting:

- the use of instant messaging services to conduct online meetings when the clients do not agree to direct contact;

- application of Sandler methodology in online meetings;

- application of the current meeting standards in remote contacts with clients.

Each of the 10 PZU Życie Sales Networks has an MSP Team Manager, which gives the sales teams an opportunity to have a real impact and focus their activities in the area of modifications and up-selling. As a result, it is possible to identify clients whose contracts are not adjusted to the market. The involvement of MSP Managers and Experts in assisting with offers makes it possible to identify new needs and systematically convert contracts to ones that are better tailored to clients’ needs. Consequently, it is possible to consolidate relationships with existing clients and to attract new insureds. Offers concerning the POZ product for selected professional groups were created in this way.

PZU Życie has been developing the ability to effectively use the apps for analyzing insurance needs during meetings with clients:

- taking advantage of all opportunities to use APKB in meetings with clients;

- engaging clients in the process of designing the best offer for them based on needs assessed using the APKB app.

Remote channels

mojePZU – all services in one place

Launching the mojePZU portal is a way of fundamentally modifying client interactions. This is a one-of-a-kind dashboard enabling clients to check their insurance cover at any time, manage their medical coverage and appointments as well as their investments.

Through the mojePZU portal, PZU Group clients may:

- buy a motor, home or travel policy and medical packages;

- view their policies and report changes;

- make an appointment with a physician;

- collect a referral for examination or an e-prescription;

- check their medical records;

- invest savings;

- report a claim and check its current status.

Modern self-service offers a single location to access PZU Group’s products and services and helps in the handling of numerous matters without the need to visit a branch or contact a hotline. It is accessible from any location and at any time, on personal computers and through the mobile app. At the end of December 2021, the mojePZU portal was used by more than 2.5 million users.

It is continuously developed and upgraded with new functions. In 2021, in the area of health, new capabilities have been added for users, including the handling of discount codes in the process of purchasing medical services for logged-in and non-logged-in clients, adding an appointment to the calendar on a mobile device along with the possibility of automatic removal when canceling an appointment, using a medical history by a non-logged-in client or using new products:

- medical packages in the form of subscriptions in the PZU Zdrowie network, providing one-year access to e.g. consultations with specialist physicians, diagnostic tests at health centers and telemedicine advice;

- prevention packages – over a dozen packages comprised of doctor consultations and examinations. Clients can choose from general health check-ups for men and women, as well as packages targeting specific health issues, including oncology, nutrition, cardiology or COVID-19 tests. Packages can be used on a one-off basis, and can be purchased for the client or their relatives.

In the area of sales of insurance products and renewals, the possibility of offering the ADD product by sales entities was added to mojePZU, and the PZU Auto insurance renewal process was launched. As a result, clients receive the offer along with information on insurance renewal electronically (via the portal). E-mail and SMS communication was also included. Moreover, information screens containing contact details of the seller who prepared and sent the offer via mojePZU were added to the website. In 2021, the possibility to pay for the policy on mojePZU on the liability start date for PZU Auto and PZU Dom products was also introduced.

Additional functionalities were also launched in the area of life insurance. Additional functionalities were also launched in the area of life insurance. These included, among others, the possibility of submitting an application for reimbursement of medicine costs in insurance for medicine, modification of group insurance accession methods through additional screens and messages as well as presentation of details for the basic health care product for small entrepreneurs, the so-called SOHO (small office/home office) clients.

Additional features were made available in the finance area, including: linking the mojePZU account with inPZU and the new service of DFE PZU and OFE PZU (socofe.pzu.pl) and automatic transition from mojePZU to inPZU or socofe platforms, preview of details of IRA and IRSA products from TFI and preview of account balances for PTE products.

Since May 2021, clients supported in the claims and benefits area have been directed to mojePZU where they can access claim/case details.

In 2021, the ability to support the new PZU Sport product was made available in the mojePZU mobile app. Holders of sports and recreation subscriptions can select activities using the app. The use of mojePZU mobile was made available to Huawei device users in AppGallery.

mojePZU comprises also the PZU Pomocni Club. It is a loyalty program through which clients obtain access to a catalog of discount codes and additional benefits.

To ensure client data security, changes were made to password validation rules and two-factor user authentication for password reset was introduced.

inPZU - an online platform for selling and handling mutual funds and pension products

In October 2018, the online inPZU transaction service to sell mutual fund units was launched. This service bypasses intermediaries and directly reaches retail clients with its new offer of special purpose funds and pension products, i.e. IRA and IRSA. inPZU is also dedicated to participants of Employee Capital Schemes. Client service is done solely in the online channel without having to pay a visit to a branch while the platform is available on all network-enabled devices. inPZU has enabled the PZU Group to build the first offer of low-cost special purpose funds in Poland.

In 2021, the following was performed on inPZU:

- a survey on client satisfaction and expectations for further development of the inPZU service was conducted;

- actions were taken to increase sales effectiveness in the online channel and to strengthen communication with new and existing clients by organizing webinars, e-mail communication, text messages and in social media;

- product campaigns were conducted for IRA, IRSA and special purpose funds;

- a lottery for participants of Employee Capital Schemes was launched to encourage them to use the inPZU service;

- integration with the mojePZU portal was continued by making information on IRA and IRSA products available on the portal;

- preparations for development of the service product offering by 7 additional special purpose funds and implementation of video identity check were completed;

- works related to the service of a new pension product based on special purpose funds – “Higher Retirement Package”, consisting of EPS, PPO, IRA and IRSA products began.

inPZU in numbers:

74.9 thousand active users handling their ECS accounts, investment portfolios, IRA and IRSA products

23.3 thousand of participants of the Employee Capital Schemes took part in the ECS lottery

4.9 million views were logged in 2021 (8.2 million since the launch)

106 thousand purchase transactions of inPZU SFIO fund participation units executed by TFI PZU’s clients

Claims handling

For the customer, the claims handling stage is the moment when they check the quality of their product. Satisfying client expectations during the claim handling or case handling process is the key to building PZU’s client relationships. Therefore, processes in this area are subject to continual improvement, in order to shorten the time of claim disbursement and develop positive customer experience.

Since the beginning of 2020, the pandemic called for modification of the existing processes and marked a turn towards more intensive use of mobile tools and applications. As a result, the number of remote inspections of damaged property was increased, leading to fast cost estimates and larger share of simplified claims handling processes.

Faster and more customized claims handling

In these times of process automation and digitalization, the customer expects the approach to be even more personalized. In PZU, a Relationship Manager maintains contact with the injured party for the duration of the claims/benefits handling process.

While handling the claim, the Relationship Manager keeps the customer informed about the progress of the case. Depending on the needs, the Relationship Manager may also provide support to the client, act as their advisor who offers specific solutions in a difficult situation. The Relationship Manager can also efficiently organize and manage all the PZU services offered in claims handling. The Relationship Manager’s task is to walk the customer through the entire process in the easiest manner possible, including by determining their preferences regarding, for instance, channels of communication or the claims handling method. Relationship Managers acquire competences in the area of various product lines, making them versatile, which allows them to manage many diverse claims handling procedures. This ensures that different cases of the same customer may be handled by the same Relationship Manager, even though the cases may concern different lines of business (separate competences) or even different companies. The new claims handling model under a formula based on client support provided by the Relationship Manager enables the injured party to avoid many formalities related to claims handling. The Relationship Manager’s role is to prepare the best solutions for clients and provide advisory services to select the most optimal choice involving, among others, the method of calculating a claim or the selection of a garage.

Before-You-Call Service

The PZU Group is deeply convinced that insurers should instill a sense of security and conviction that someone will always be there for the customer should trouble arise. Accordingly, the PZU Group wishes to be there for its clients when they need support the most, often even before they formally report their claim.

The Before-You-Call Service is a solution within the framework of which the insurer initiates contact with the customer and offers them actual assistance before the formal notification of the claim, putting both the client and their needs first. The Before-You-Call Service is dedicated to customers who have experienced an unpleasant random event in which their property was damaged.

After the occurrence of an insurable event, such as a fire, gas explosion or tornado, an attempt is made to identify the client based on information obtained from publicly available sources, including the Internet or radio. In cases where the injured person is positively identified as a PZU customer, contact with the client is established to provide actual assistance in the unfortunate situation (for instance, if the policy cover provides for a substitute apartment, it will be offered to the client during the first contact). Registration of the claim may be performed on a different day, at a time convenient for the client.

Data for 2021:

- 77 registered events;

- 8 events in which PZU clients were injured;

- 137 injured PZU clients;

- 137 persons we managed to contact;

- 135 registered assistance cases, including 16 registered claims

Crisis management procedure in claims handling

The PZU’s procedure describes many mechanisms applied to catastrophic claims. These processes are predominantly focused on how to:

- effectively reach the customer, provide assistance and comprehensive services in the shortest possible time following the occurrence of the damage;

- shorten the claims handling time;

- adjust the claims handling process to client expectations;

- improve the quality of service and customer satisfaction.

The following steps are most frequently taken within the framework of this procedure:

- launch of a mobile office and four mobile mini offices;

- simplification of the processes of claims reporting and handling;

- re-allocation of resources to areas affected by the disaster and to substantive claims handling processes;

- provision of urgent need items to the affected victims, such as tarpaulins, cleaning products, foils, foodstuffs and potable water.

Catastrophic events which occurred in 2021, caused damage of significant scale. From 24 June to 30 September, about 63,500 property claims and claims pertaining to crops were reported. The steps and improvements made allowed those claims to be handled quickly. The applied simplifications enabled determination of the number of claims to be paid without the need to draft a detailed cost estimate. The implementation of robots allowed to automatically disburse the advance payment or the claim itself already on the first business day following the date of reporting the claim. Mobile offices were set up in voivodships most affected by disasters. A team of experts was appointed, which followed weather reports and media publications on potential hazards.

Comprehensive Claims Handling model for corporate clients

The comprehensive model of corporate customers' claims handling, implemented in PZU, is dedicated to PZU's largest clients, VIP clients basing on the amount of written premium in the field of communication damages. Main reason of the implemented model is to guarantee the damage handling service at the highest level by implementing solutions which was not offered on the motor claims handling market before.

The main pillar of the model is broad cooperation among sales, claims handling and underwriting teams, in order to provide the best quality services for key account clients.

In this dedicated model, claims handling is based on an in-depth client analysis in terms of the size and structure of their fleet, the loss ratio, and advisory services as regards fleet-wide solutions designed to improve the client’s loss ratio. Every client is serviced by their appointed claims handling relationship managers. The managers organize meetings with the client’s representatives, in which the formal requirements in the area of contact and communications are agreed. After an analysis, potential solutions are proposed to reduce the client’s loss ratio. Such meetings are organized at various stages of the insurance agreement, relative to the client’s needs and ability to implement new solutions. These actions are supported by marketing materials.

The above described solutions are founded on a broadly conceived business relationship and shared understanding with the client as regards implementation of solutions that can minimize the client’s loss ratio as well as costs.

This service model ensures that top-quality claims handling service is provided; so far, it represents an unparalleled approach in the motor claims handling market.

The claims handling approach of LINK4 is aligned with the philosophy and strategy of the PZU Group. One of its objectives is to develop a long-term relationship with the client, by best possible adaptation to their needs, using advanced IT tools.

Towing

Since 2021, LINK4 has been providing vehicle towing services for all incident participants. Towing is provided across the entire area of Poland, in a 24/7 regime. The Company provides towing to all types of vehicles, including specialized vehicles and lorries. The service contributes to building and strengthening relationships with the incident participants, irrespective of whether they are LINK4 customers or not.

ADD claims handling model in LINK4

The guiding principle of LINK4’s operation is that the ADD claims handling should be swift and simple. The implementation of such simple and friendly model, and reduction of the formal steps required, has generated a significant growth in customer satisfaction. LINK4 employees are able to determine the amount of the benefit due as early as when the customer reports the claim by phone. The claim handling process has been reduced to a minimum – LINK4 collects only absolutely necessary data. The disbursement of the claim can be effected even in a few minutes.

LINK4 Claims Handling Academy

LINK4 Claims Handling Academy is a training and development program for employees of the Claims Handling department. These include in particular:

- listening to recordings, whereby the business trainer and the claim handling employee listen and analyze together recorded telephone conversations between the employee and customers. The purpose of these sessions is to improve the employee’s communication and interpersonal skills;

- Claims Handling School – is a regular development project designed to provide training and workshops for beginner employees of Claims Handling Teams. During the meetings, specific claims handling cases and issues are discussed, including Customer Service. The purpose of these sessions is to improve employees’ substantive knowledge and translate it into the practice of their everyday duties.

- thematic training is organized in response to the on-going needs of the Claims Division employees, in order to improve their claims handling expertise and competences.

- mentoring is series of regular meetings allowing Claims Division employees to familiarize themselves with the work of other Teams in the Division. This format allows employees to expand their knowledge and acquire new, practical skills shared with them by experienced colleagues from other teams. Thanks to the mentoring project, employees can see a more general direction of their career, build relations with members of other teams, as well as gain a broader perspective on how their work links up with the work of other areas of the Claims Division.

- Multiskill Claims Handling Manager – is a project designed to support the smallest Claims Handling Teams by other Teams, at the time of increased work volume. When participating in the project, employees can get acquainted with the specific tasks performed by the Property Claims Handling Department and the Simplified Claims Handling Department, as well as improve their competencies.

All the above described activities focus on supporting LINK4 employees in the performance of their everyday duties. They are designed to consolidate their substantive and practical knowledge, which translates directly into customer service quality in the claims handling process. Well-prepared employees find it easier to engage into a focused conversation with the customer and perform their duties much faster, which is directly reflected in the time needed for claims handling.