“The PZU Group is trusted by 22 million clients in five European countries, including 16 million Polish residents who hold insurance policies marked with the PZU brand. We are proud to have won their trust, but we consider it to be a great responsibility. We endeavor to ensure that client experience is always positive at every stage of contact with the PZU Group. Leveraging in full the opportunities afforded by digitalization, roboticization and artificial intelligence, we do not forget about what is irreplaceable in our business: direct and long-term relations with other people.”

“The PZU Group is trusted by 22 million clients in five European countries, including 16 million Polish residents who hold insurance policies marked with the PZU brand. We are proud to have won their trust, but we consider it to be a great responsibility. We endeavor to ensure that client experience is always positive at every stage of contact with the PZU Group. Leveraging in full the opportunities afforded by digitalization, roboticization and artificial intelligence, we do not forget about what is irreplaceable in our business: direct and long-term relations with other people.”

In recent years, the PZU Group has been undergoing a transition from a collection of companies operating separately towards an ecosystem striving to meet the needs of its clients in a comprehensive manner.

A mindset focused on the client has long been a component of PZU’s DNA. The Group listens to the client’s voice, collects information about the client’s experience and emotions, examines complaints and recommends changes that will ensure the client maximum satisfaction. In its approach to client relations, the PZU Group has defined the following 3 fundamental risks:

- misselling risk,

- compliance risk in the marketing communication,

- the risk pertaining to disclosure of personal data and data subject to insurance secrecy to unauthorized persons.

The implemented policies, procedures and controls enable a responsible management of these risks. All these activities help us design a positive client experience.

Value proposition for the client

Product strategy

It is not the number of products that determines PZU’s competitive edge and its unrivaled value proposition on the Polish market, but their quality and, above all, their alignment to client needs as they evolve over their lifetimes. PZU is always present where clients are in need of financial and insurance services, from birth to education and maturity until retirement.

PZU brings together all of the PZU Group’s activities and integrates them in a client-focused manner: life insurance, non-life insurance, health insurance, investments, pensions, health care, banking and assistance services. This approach drives the transformation of insurers from focusing primarily on valuation and transfer of risk toward being an advisory and service company (utilizing the technological know-how).

PZU is poised to offer comprehensive solutions in a single location to currently very demanding clients, individual and corporate alike, to respond to the entirety of their needs: to help them lead a healthy life and operate in a sustainable fashion, provide medical care to their families or employees, protect their assets and facilitate asset growth, afford a feeling of stabilization and taking good care of their relatives regardless of what the future brings.

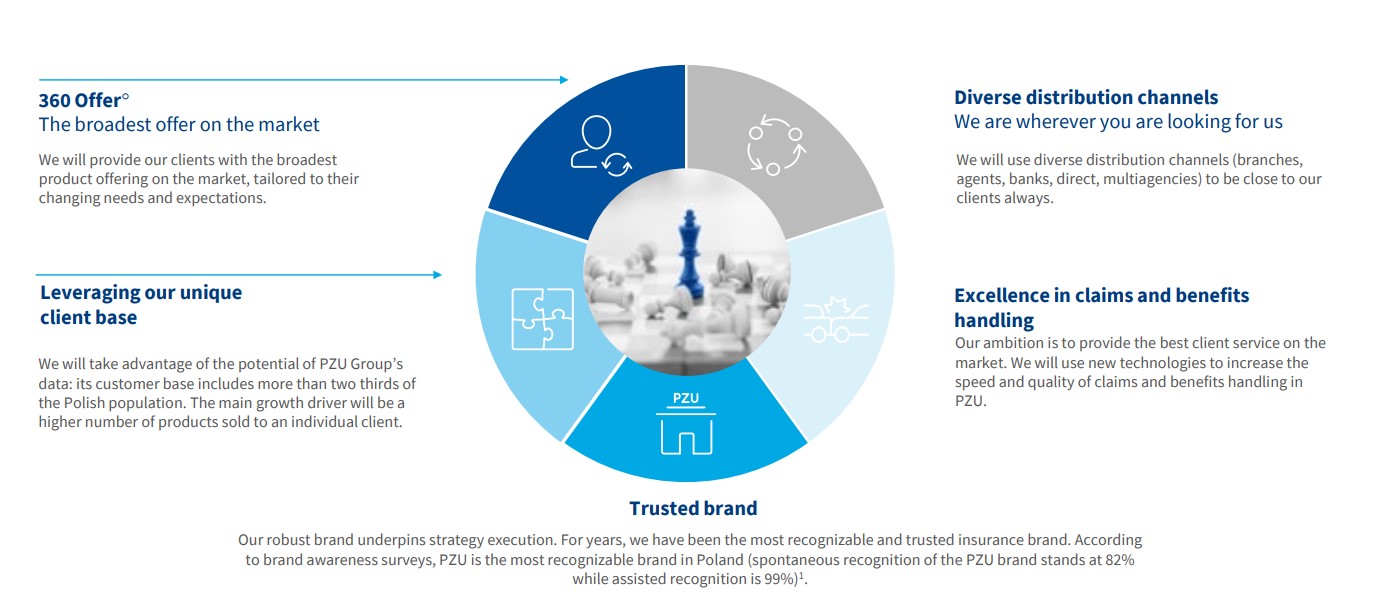

PZU Strategy – #PZU Potential and growth – We care about the most important things in life – calls for the pursuit of a new vision of product design and distribution. The 360° offer will be a personalized, comprehensive and dynamic product offering suited to the constantly changing expectations and needs of clients at each stage of their life. The PZU Group also expands its offering for businesses to include support services, such as risk management assistance through advisory services and implementation of advanced tools and providing an IT system for fleet management (insurance administration, fleet risk management, advisory services, ongoing legal support for Polish international fleets).

By using the latest tools and new technologies, the PZU Group improves the management of relations with clients. For this purpose, it uses new analytical environments, which automate and support decision-making processes. Introduction of Interactive CRM will improve communication and make sales processes more effective. The deployment of CRM processes shared between PZU and PZU Group’s banks is also planned.

Flexible sales and service provision

The PZU Group intends to develop a strong position in all sales channels: it has over 400 branches, nearly 1,500 agent offices, cooperates with numerous multi-agencies, brokers and banks as well as leaders of the growing e-commerce market and energy suppliers. In total, over 70,000 staff work in this sales network. The PZU Group is intensely developing the digital channel through the mojePZU platform, which was used by over 2.5 million clients at the end of 2021. By pursuing its strategy for 2021–2024, the Group seeks to empower the client to be able to freely shape each stage and the whole course of the purchasing process. This will be possible owing to the multitude of available distribution channels and the freedom to move between them. For instance, the client may receive information about the product during a meeting with an agent, learn the details and additional possibilities while visiting an outlet, complete the purchase online via the mojePZU platform – or do things completely differently.

Through an omnichannel approach, the PZU Group will be able to reach clients through various distribution channels suited to their needs and preferences. Clients will have access to a broad range of modern products.

1 Kantar, brand tracking, December 2021

Modern ecosystems

One of the PZU Group’s strategic goals is the development of ecosystems for both institutional and retail clients:

Ecosystem – benefits

The goal of building the Benefits Ecosystem is to create new interactions with clients based on their everyday life activities such as physical activity, healthy lifestyle, sports, health, family, safety.

The ecosystem consists of a set of advanced digital tools targeted at both employers and individual customers. To institutions, the ecosystem offers functionalities for managing non-salary benefits, engaging the community of their employees and for handling applications and service processes, while end users obtain access to various types of benefits: products and services of the PZU Group, such as PZU Sport or PZU Cash, and numerous products offered by external partners.

Ecosystem – drivers

It is an extensive ecosystem that provides comprehensive assistance, including support when buying or selling a car, checks of a vehicle's technical condition, possible repairs and legal assistance, discounts on services from the Group's partners, or arranging a replacement car. All the services are be available at a single point of access, through safe and user-friendly digital tools. The next planned steps include services such as providing repair history, access to loyalty programs, tire service, glass service, etc. The new platform for drivers is available to anyone, even those without insurance.

Ecosystem – health and medical care

The PZU Group wants to become a comprehensive medical advisor through a revolutionary approach to medical care. The new model will be based on: preventive healthcare; digital service (with the use of artificial intelligence – AI); comprehensiveness of services; Integrated Information System; medical decisions based on medical protocols, data and AI; possibility of providing treatment outside of the outpatient clinic. In order to implement the new model, the Group plans to cooperate with the health care system, integrate medical centers and develop the PZU Zdrowie brand. In the health area, the PZU Group will offer services relating to healthy nutrition and physical activity, preventive medical testing and full medical care – in the form of insurance, subscriptions or for fee services. The system will include teleconsultations and remote patient monitoring and household treatment while at the same time giving all of the interested parties rapid direct access to physicians in PZU Zdrowie’s proprietary outlet network that is constantly growing and undergoing integration.

Ecosystem – special offer for seniors

To address the challenges associated with demographic shifts, the PZU Group will put forward an offer to improve the wellbeing of seniors. This offer will include the following: insurance corresponding to their expectations in terms of scope and sales and service channels, medical services with special emphasis placed on remote care at home and treatment in health spas, special safe bank and investment products and also a package of services to support seniors in their day-to-day life and community activities: ranging from assistance in traveling to see a physician, delivering medicines, organizing physical therapy, to household repairs or participation in sports classes and courses.